south carolina state tax customer service

Contact us by phone mail or in person. Visit the Ombudsman web.

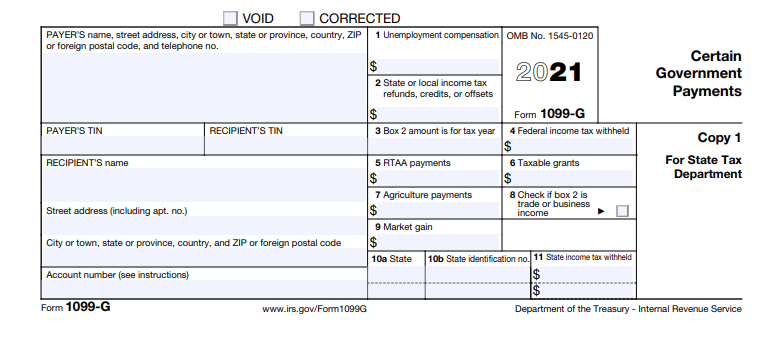

Accessing Your 1099 G Sc Department Of Employment And Workforce

The statewide sales and use tax rate is six percent 6.

. Should the hotel merchant or vendor have any questions they should reach out directly to the State for clarification. Manage Your South Carolina Tax Accounts Online Securely file pay and register most South Carolina taxes using the SCDORs free online tax portal MyDORWAY. Your Member ID is provided on.

Contact the Governors Office. Find the office you need to visit Make an appointment by calling the appointment number for that office Find a Taxpayer Assistance Center Office Enter Your 5-Digit ZIP Code. These are the supported South Carolina state tax forms on FreeTaxUSA.

South Carolina Individual Income Tax Return. The NCDOR is committed quality customer service. SalesTaxdorscgov What is Sales Tax.

Request a six month filing extension for your South Carolina Individual Income Taxes by. View All Online Services. Popular in Education and Employment.

File Pay Apply for a Business Tax Account Upload W2s Get more information on the notice I received Get more information on the appeals process Check my Business Income Tax refund. SCDOR provides South Carolina t axpayers with a free and s ecure t ax portal known as MyDORWAY. Email SCGOV from our contact page.

Call 800-768-5858 to set up your access to the State Disbursement Units interactive voice response system IVR using your Member ID. The official South Carolina business web portal provides information to new and existing business owners about South Carolinas requirements for taxes permits licenses and. Get to kno w.

Manage multiple tax accounts from one. For general information call 1-877-252-3052 and for individual income tax refund inquiries call 1. At the close of business on Thursday November 10 2022 the South Carolina Department of Motor Vehicles SCDMV branch in Woodruff located at 351 South Main Street in Spartanburg.

Are Travel IBA 6th digit 1 2 3 4 transactions sales tax. SC Office of the Ombudsman. Sales tax is imposed on the sale of goods and certain services in South Carolina.

Open a college savings account apply to teach in South Carolina or browse state job openings. You have the right to apply for assistance from the South Carolina Department of Revenue SCDOR. Pa ying your balance due online using MyDORWAY on or before the due date.

Call directly at 803-771-0131 x1.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

North Carolina History Native American History American

North Carolina Income Tax Calculator Smartasset

Pin By Mfg Tax Service On Http Www Mfgtaxservice Com Tax Prep Tax Preparation Services Tax Preparation

Is Food Taxable In South Carolina Taxjar

Ultimate Guide To Understanding South Carolina Property Taxes

Irs Data Show Florida Texas South Carolina Are Strongest Tax Base Magnets New York Illinois New Jersey Least Data Show Data Irs

South Carolina Sales Tax Guide And Calculator 2022 Taxjar

South Carolina Sales Tax On Cars Everything You Need To Know

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Small Towns Usa States

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

Irs Installment Agreement Greensboro Nc Mm Financial Consulting Inc Internal Revenue Service Greensboro Irs

Currently Non Collectible Status Cnc Ny Ny 10035 Www Mmfinancial Org Irs Taxes Internal Revenue Service Irs

Monday Map State Local Taxes Fees On Wireless Service Infographic Map Online Lottery Lottery

South Carolina Covid 19 Resources Sc Office Of The State Treasurer